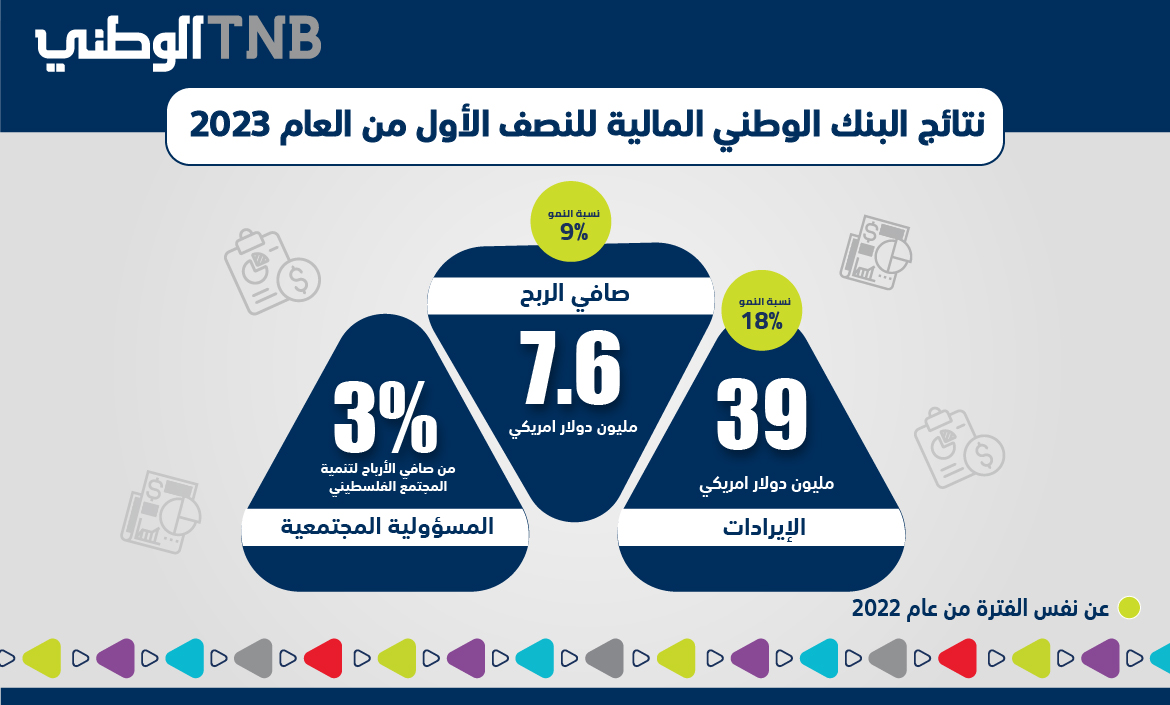

The National Bank announced the results of its preliminary semi-annual financial statements for 2023. Growth was achieved in all financial indicators, as the bank’s net profits grew by 9% compared to the same period in 2022 to a record 7.6 million US dollars. As for total income, a 16% growth was recorded, with about 38 million US dollars according to data from June 30, 2023.

The growth in income reflects the growth in net interest and commission income. This is attributed to the growth of the direct credit facilities portfolio for the second quarter of this year by $19 million compared to the end of 2022, to a record $952.6 million. TNB's semi-annual financial statements for 2023 indicated that the bank's total assets reached 1.4 billion US dollars, and its customers' deposits increased to 1.2 billion US dollars. It should be noted that these results are preliminary and subject to the approval of the Palestine Monetary Authority.

TNB Chairman of the Board of Directors, Samir Zraiq, commented that this financial performance reflects TNB’s strength and effective strategy. The benefits are finally showing with steady and sustainable growth. He pointed out that for two consecutive years, the Board of Directors and Executive Management worked side by side to lay the foundations and consolidate the rules necessary to achieve more success.

Zraiq stressed that TNB will continue to focus on efficient financial portfolios, strengthening its financial position, investing in digital technology, and expansion through the plans and programs approved by the executive management. It will also continue to implement the highest standards of good governance that directly benefit the institution’s performance.

For his part, TNB CEO, Salameh Khalil, expressed his happiness with the semi-annual financial results for 2023, stressing the bank’s financial solvency and the continuous growth of its profits in line with the strategic objectives. He attributed this to TNB’s expansion of lending to various sectors during the current half year, in a way that achieves the bank’s commitment and role to invest in Palestine and develop its economic sectors.

Khalil indicated that TNB will work during the second half of the year to complete the implementation of a new banking system and modernize its technological systems to provide the highest quality banking services to customers and a distinctive banking experience. Khalil added that TNB continues to pursue deliberate expansion by opening branches and offices in places that are gathering points for Palestinian citizens, such as municipalities and courts.