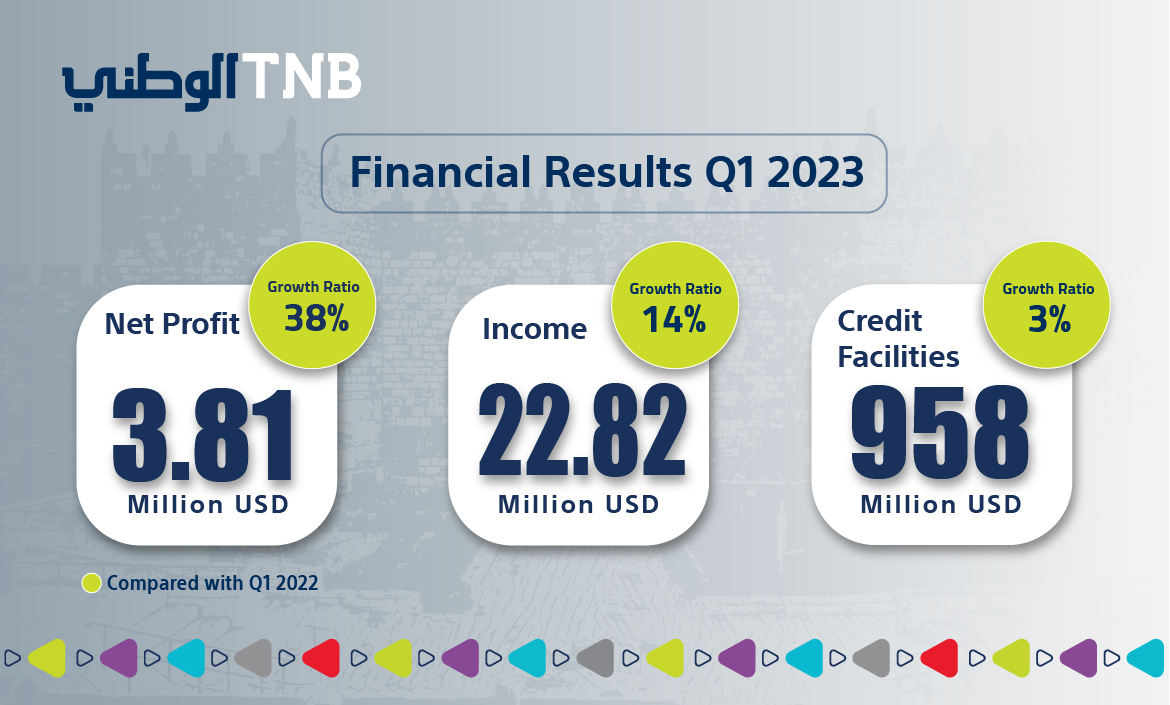

The National Bank (TNB) announced its financial results for the first quarter ending in March 31, 2023. The bank achieved strong results, with net profits reaching US$ 3.8 million, compared to US$ 2.8 million during the first quarter of 2022, representing an increase of 38%.

The financial statements for the last three months of 2023 indicated that TNB’s customer deposits grew to reach US$ 1.22 billion compared to the end of 2022 where it reached US$ 1.2 billion. The Bank's assets amounted to about US$ 1.5 billion, and the direct credit facilities portfolio also grew to reach about US$ 958 million, an increase of US$ 24 million, compared to the end of 2022, which amounted to about US$ 4,93 million.

Commenting on the financial results for the first quarter of the year, TNB Chairman of the Board, Samir Zraiq said: "Once again, TNB is achieving a strong financial performance and a remarkable growth of more than 20% in most income statement items. This pace of growth reaffirms the effectiveness of our plans and TNB’s efficiency in managing financial portfolios”. Zraiq added, "This outstanding performance places an additional responsibility on our shareholders and customers to achieve stronger results and new successes in the Palestinian banking market."

Zraiq stressed the strength of the bank's financial position and its strong capital base, which supports the bank's strategic plans to grow, develop and expand to meet the aspirations of our customers in all economic sectors, ensure better returns for shareholders, and contribute to the development of society.

For his part, TNB CEO, Salameh Khalil, said, "We started the year strong and achieved very good growth in profits and operational performance, these are satisfactory results, and we look forward to achieving more successes."

Khalil pointed out that the National Bank plans to launch new services and products during the year that focus on meeting the financial needs of various segments of Palestinian society, introducing additional developments to the technological environment, in addition to boosting the bank's geographical spread and the delivery of banking services to more marginalized segments in the country, with a focus on the transition to sustainability and reflecting such on the bank's business.